1 Introduction

Shipping in the Arctic is largely driven by natural resource extraction. Whether in the Russian Arctic or the Canadian Arctic, it is resource extraction that generates the most voyages and the largest share of total tonnage,1 while transits, minimal in the Canadian Arctic and modest along the NSR, remains confronted with major logistical constraints bearing on liner shipping, notably just-in-time logistics.2 Thus, the expansion of shipping in the Arctic at present largely rests on efficient coordination between resource extractive companies and their shipping component, and the need to adapt supply chain management strategies and logistical solutions that compensate for the high operational risks in the Arctic environment to make their operations more reliable, safer, and resilient. However, as pointed out by Sauer and Seuring,3 limited research has been done on supply chain management for the extractive industries and this applies in particular to extractive projects in the Arctic region.4

The complexity of commercial shipping and logistical operations in Arctic waters is well-documented in the literature.5 Few papers, however, tackle the ways supply chain management or logistical management developed in Arctic transportation. A few exceptions can be found in Harwood (1961),6 Gunnarsson (2013),7 Tsvetkova (2016),8 Weigell et al (2020),9 Sergeev et al (2021),10 and Taarup-Esbense and Gudmestad (2022).11 These studies underline the fact that the critical difficulties specific to Arctic transportation and logistics force companies to better coordinate and manage logistics and, crucially, control and plan, in order to mitigate Arctic hazards. Interestingly, there is very little in the literature about the concept of supply chain control, but some exceptions are Tsay (1995),12 Lau et al (2005),13 Sarimveis et al (2008),14 and Makris et al (2011).15 Also, there appears to be a need for more focus on the network aspects of supply chain strategies, rather than the current focus on manufacturing aspects. As shown by Basnet and Seuring (2014),16 research has focused on strategy goals, such as agility, flexibility, responsiveness, and cost-efficiency rather than supply chain design configurations and the trade-offs inherent to these configurations, in order to take into account specific market constraints.

The severe challenges of year-round operations in the Arctic adds several additional risk factors to supply chains (Figure 1) compared to similar industrial operations in more southernly locations.17 Zsidisin and Henke (2019)18 showed that supply chain risks can affect the flow of products, resources, finances, and information, and therefore greatly impact operations and production. According to Hopkin (2018),19 to compensate for higher operational risk, organizations working in the Arctic can utilize various technological and organizational advances designed to reduce or mitigate the impacts of common Arctic risks. This can be done by creating preventive and protective barriers to deal with supply chain risks, and as shown by Hollnagel et al. (2015)20 and Taarup-Esbensen (2020)21 develop adaptive capacity to foresee changes in the operational environment. Such an approach can lead to supply-driven innovations and promote supply chain strategies to enhance reliability and counteract higher operational risks. But there must also be financial justification for adopting more costly solutions, such as constructing high ice-class vessels with a high degree of winterization to transport Arctic commodities. Therefore, only the most profitable businesses and operations can afford the costliest risk mitigation measures.

Source: DNV GL.

Increasingly, Russian resource extractive companies in the high Arctic are relying on maritime logistics to bring their commodities out of the Arctic and to international markets. The companies operate year-round and regularly transport their commodities out of the Arctic despite very challenging operational conditions. This development is strongly supported by the Russian government. Here, the Northern Sea Route (NSR) plays a central role as a vital transport corridor. For the independent LNG company Novatek, which currently contributes the lion share of cargo volume transported on the NSR, there was also no alternative solution, as the state-owned Gazprom has a monopoly on Russian gas exports by pipeline.

The key question is how have the resource extractive companies achieved this? How has Russia developed supply chain resilience in the Arctic and transport reliability? Which supply chain policies and strategies have been promoted and implemented to make this possible? And more recently, how will Russian Arctic resource development be affected by Western sanctions on Russia, following the Russian invasion in Ukraine? The article attempts to answer these questions. The article does not focus on the environmental impacts of the extractive industries on the Arctic environment.

The article is structured in such a way that Section 2 describes the methodology; Section 3 concerns the export of commodities on the NSR; and Section 4 addresses the concept of supply chain control and why resource extractive companies in the Arctic opt to take control of their whole supply chains. Section 5 provides analyses of ten supply chain solutions implemented in the Russian Arctic to improve supply chain resilience and transport reliability. Section 6 discusses intermodal sea-land transport connections in the Russian Arctic; Section 7 the impact of recent Western sanctions on Russia’s Arctic projects; and Section 8 the future importance of Russia’s Arctic export terminals. Section 9 presents the main conclusion.

2 Methodology

Area of study. The area of study is the Northern Sea Route (NSR). The NSR is defined by Russian law as the Water Area along the northern coast of Russia,22 extending from the meridian of Cape Zhelaniya and along the east coast of the Novaya Zemlya Archipelago (the entrance to the Kara Sea), to the Line of Maritime Demarcation between Russia and the USA and Cape Dezhnev in the Bering Strait. The distance west to east is ca. 5,600 kilometres. The NSR Water Area extends to 200 nautical miles from the coast and includes Russian internal waters, the territorial sea, the contiguous zone, and the exclusive economic zone.

Theoretical framework. The theoretical framework of the study is based on the principles of supply chain management and logistics. The study is in particular guided by the work of Hopkin23 on how organizations can implement both technological and organizational measures to prevent or mitigate supply chain risks, and if hazards do occur, have in place protective measures that will minimize unwanted consequences. Technical solutions are shown to be most important early on to prevent hazards, and risk management capabilities and resource coordination become increasingly important in the longer-term to mitigate any negative consequences. Identifying the right balance between introducing new technology and effective risk management makes the overall system more resilient.

Data sources and method of analysis. The empirical data for the years 2016–2021 came from the Centre for High North Logistics’ (CHNL) NSR Shipping Database managed by CHNL’s Information Office in Murmansk, based on analysed Automatic Identification System (AIS) data provided by the Canadian satellite company exactEarth. All vessels officially registered as working on the NSR each year by the Northern Sea Route Administration (NSRA) in Moscow, were analysed and the details of their voyages recorded. In addition to academic literature, internet sources were used to further clarify the nature of various shipping activities and events from ship company websites, maritime newsletters, trade journals, and press releases.

3 Increased export of Arctic commodities by shipping in 2016–2021

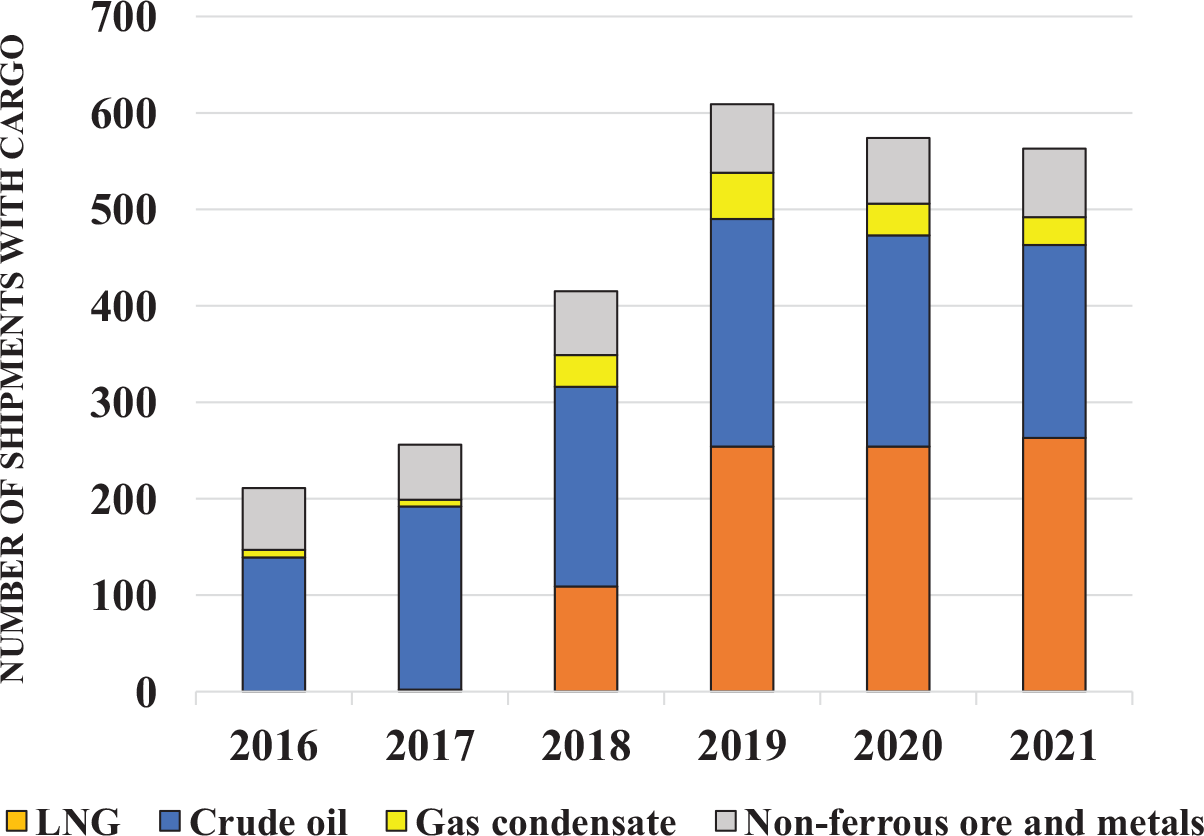

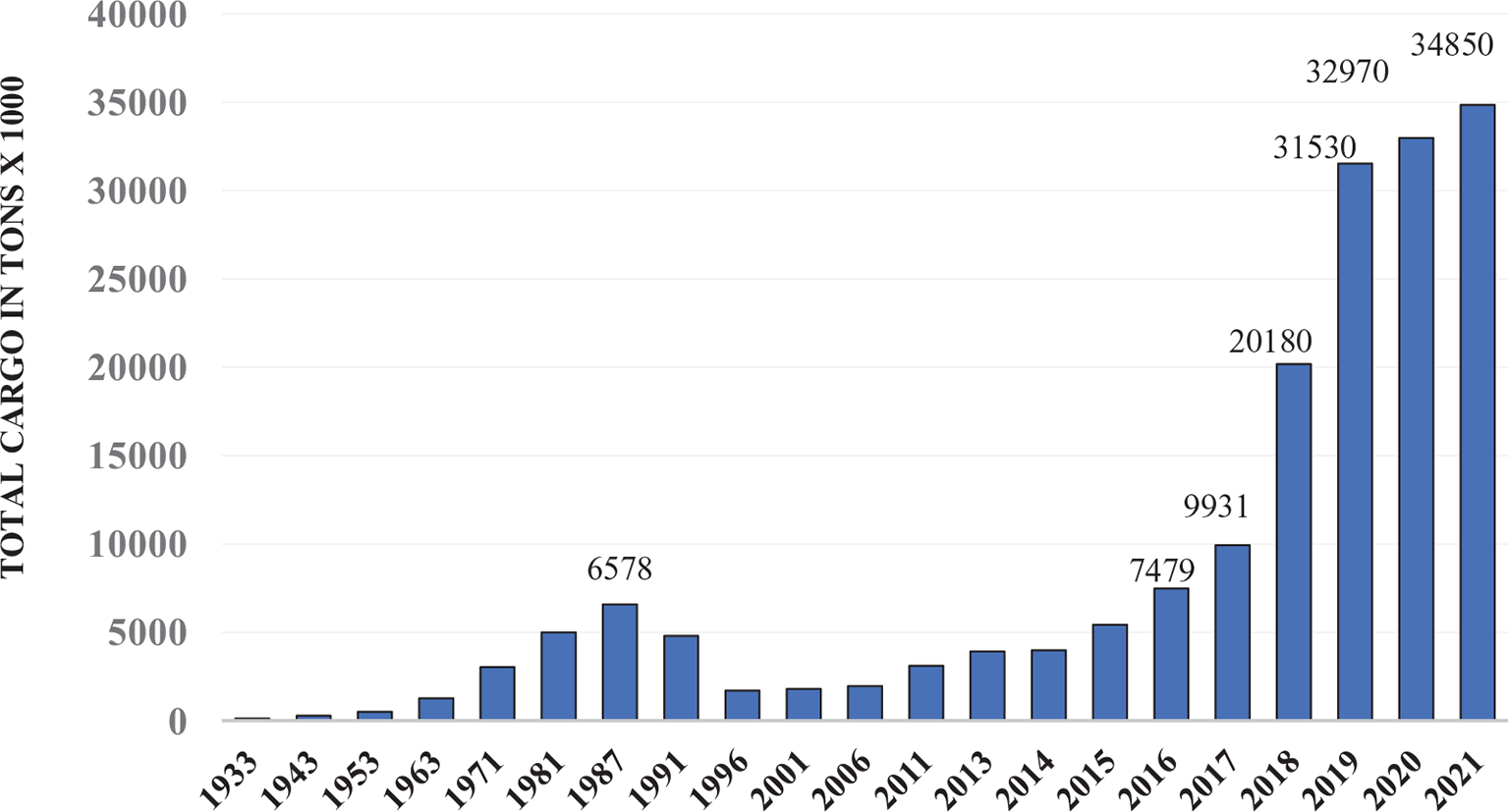

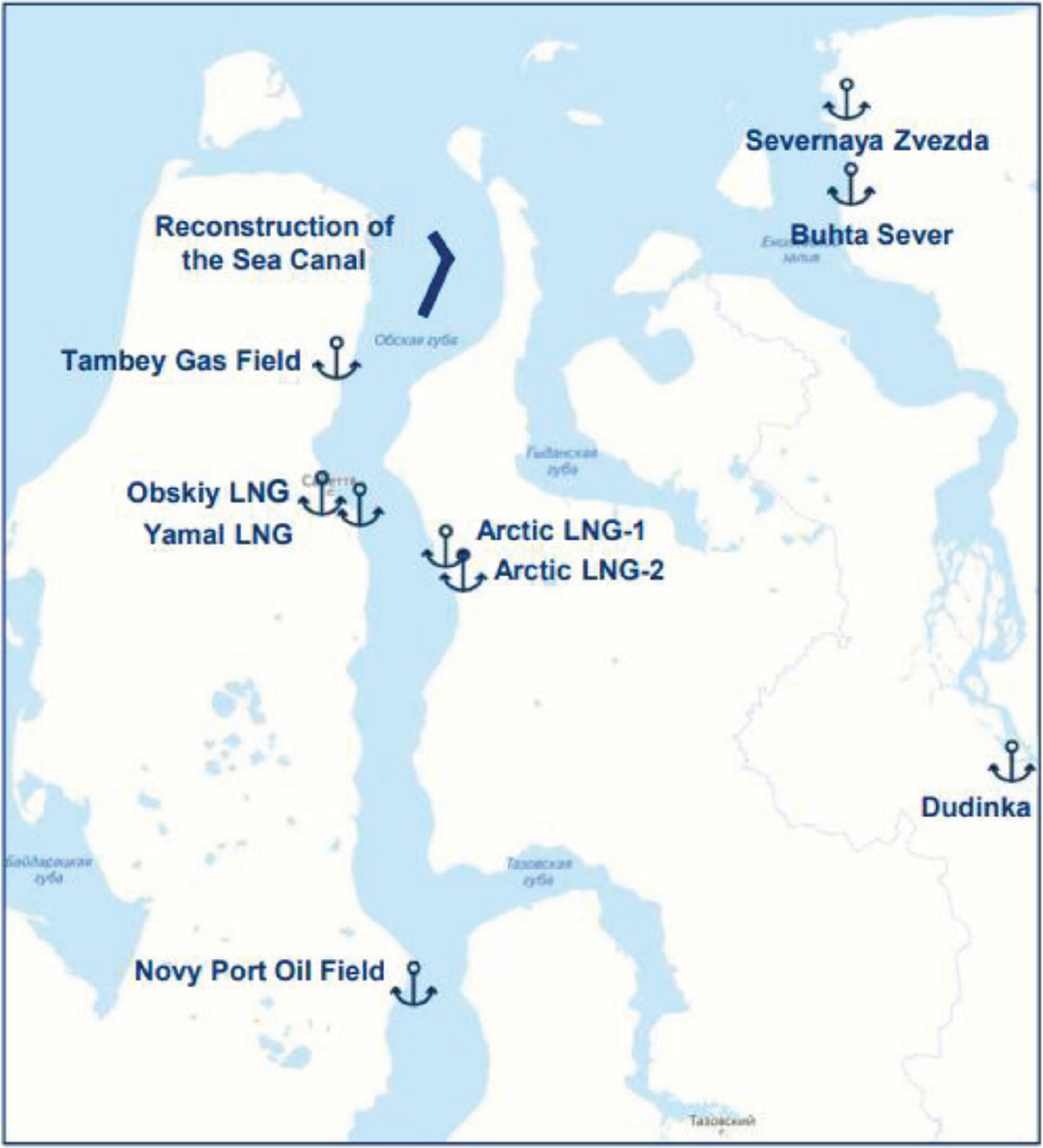

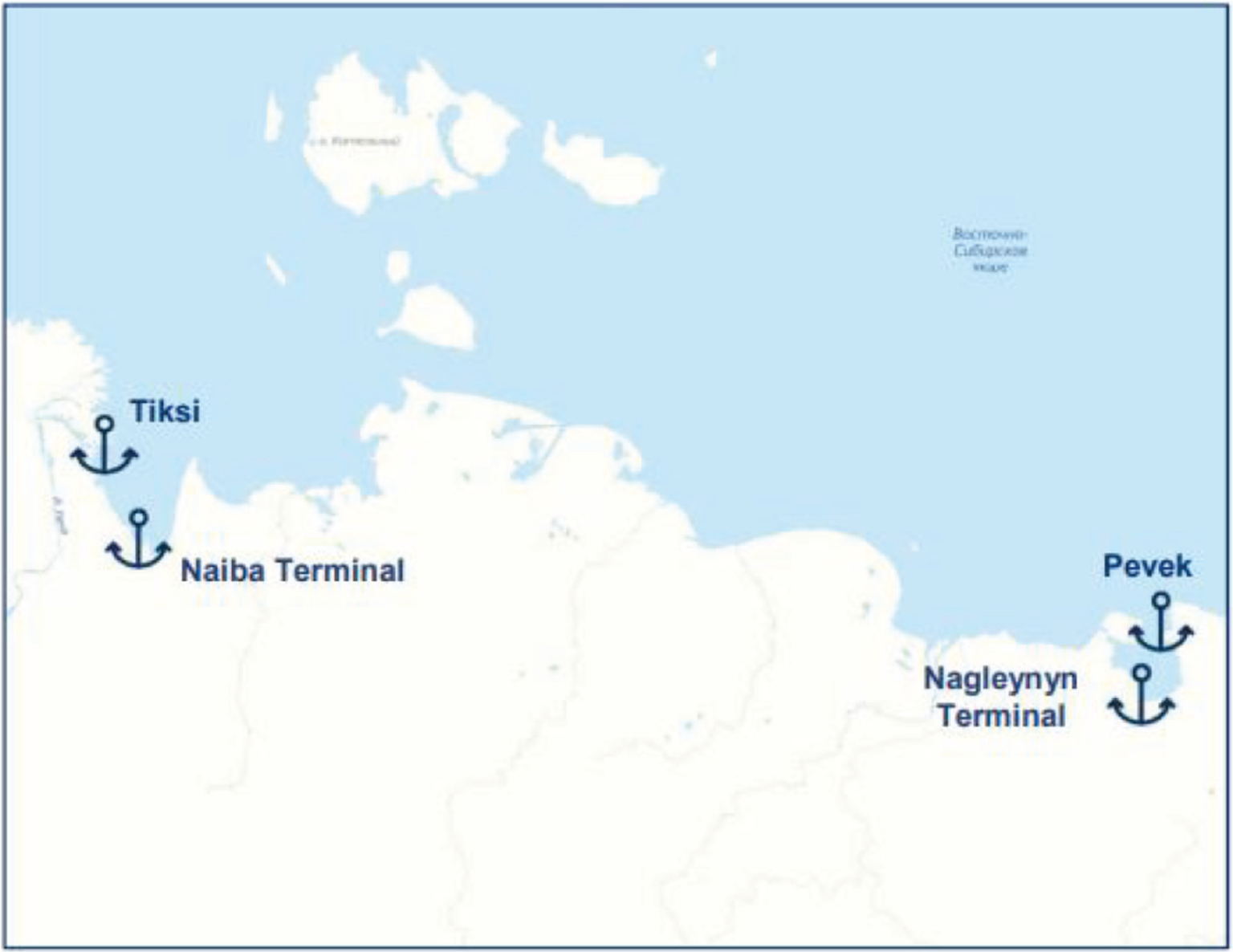

Over the past several years, Russia’s main focus has been to escalate the development of its vast energy and mineral resource base in its Arctic zone and ship the raw materials year-round along the NSR, first west to Europe and then increasingly eastward to the Asian market. Shipments of LNG, crude oil, gas condensate, and non-ferrous ores and metals from within the NSR increased rapidly during 2016–2021 (Figure 2), as did total cargo volumes on the NSR (Figure 3). In 2016 shipments with commodities for export on the NSR were 211, which increased to 563–609 shipments per year during 2019–2021 or on average 1.54–1.67 shipments per day. Several new projects were under development or in the planning stages. Never before has the high Arctic seen an industrial expansion of this magnitude. Most of the projects and construction of new maritime infrastructure are in the western part of the NSR in the Ob Bay (Figure 4), but some were already planned in the eastern part (Figure 5). Before, all exports of Russian gas to Europe, as well as some oil exports, flowed through a network of pipelines from fields in Western Siberia and the Yamal-Nanets region.24 The main exception is shipment of oil from both the Varandey terminal (started production in 2008) and Prirazlomnaya offshore platform (started production in 2014) in the Pechora Sea, both just outside the western border of the NSR.25

Source: CHNL’s NSR Shipping Database.

Source: Northern Sea Route Administration.

Source: Atomflot.

Source: Atomflot.

This policy shift in Russia to convert Arctic gas to LNG, and to ship both oil and LNG from Arctic terminals, rather than by pipelines to Europe, provided Russia with increased transport flexibility to ship the commodities to other destinations based on medium to long-term market needs. For Russia these preferred market locations being East and South Asia, including countries in Africa and Latin America.26 Russia’s increased focus on the Asian market became apparent after Russia was first sanctioned by the West after Russia’s annexation of Crimea in 2014. The new emphasis on the Asian market also coincides with high demand for natural resources in Asia, and an ongoing reduction of sea ice coverage and thickness along the NSR,27 which has improved navigability, particularly during the summer-autumn navigational season.28 For Russia, maritime transport will, more than other modes of transport, increase the Russian presence in the Arctic and in the increasingly more navigable Arctic Ocean, which is considered strategically important to Russia in terms of national security and in servicing and maintaining security/military bases in the Arctic region.29

4 Supply chain control on the NSR

4.1 Supply chain control by resource developers

Lack of any preexisting infrastructure in the remote Russian Arctic, forces Russian energy and mineral resource companies to first construct their own basic support infrastructure in the Arctic. This can include everything from supplying electrical power, construction of temporary housing for workers, developing communication systems, to building transportation infrastructure. This is in addition to field exploration and research, development of extractive fields, and power plant construction. All construction materials, equipment and supplies need to be brought in from outside sources. For transport the companies are dependent on the NSR, which is ice-covered for up to seven months of the year,30 as the only viable transport route, both regarding supplies to the Arctic and transport of commodities out of the Arctic. Russia’s largest energy and mineral resource companies are all involved in Arctic projects, both Russian state-owned companies (Gazprom, Rosneft, and Rosatom) as well as independent or privately owned Russian companies (Nornickel and Novatek; and Lukoil operating on the coast of the Pechora Sea). Russian companies are majority shareholders in all the projects and in charge of all project operations, but several foreign engineering, energy and shipping companies have been hired on short-term contracts during the past several years.31

Russian companies are heavily invested in their Arctic projects and need to be certain that all components of the supply chain function accordingly. They are gaining valuable experience in managing supply chains in the remote Arctic under very challenging operational conditions, and this experience will become increasingly important as they expand their resource base with additional extractive fields and plan other Arctic projects. As a result, essentially all aspects of Russian resource developers’ operations, from resource extraction and production, to transport and customers’ deliveries, are managed by the companies themselves and their subsidiaries. They have simplified the supply chain and taken control over all its key components.

4.2 Government’s political, legal and financial support

This control approach has also been adopted by the Russian government. Both central and regional governments strongly support the extractive industries in the Russian Arctic. To keep control of all infrastructure development, the government, in December 2018, made the powerful state-owned Rosatom the NSR’s infrastructure operator, in control of all Arctic infrastructure investments and traffic development on the NSR.32 Rosatom is also the provider of essential nuclear icebreaking services on the NSR, through its subsidiary Atomflot. A year before, or in December 2017, the government had enacted a law (amendments to the federal shipping code) that only allows Russian flag vessels to transport Russian hydrocarbon resources (e.g. LNG, gas condensate, crude oil, and coal) within the borders of the NSR.33 This law came into force on February 1, 2018. Then came the government requirement that ships transporting hydrocarbons on the NSR should be built by Russian shipyards. These requirements are meant to strengthen the future role of the Russian shipping industry and domestic shipping companies operating in Arctic waters. Though foreign-flagged and foreign built vessels on long-term contracts signed before this date (i.e. carriers for Yamal LNG) were excluded from these requirements, this sets the tone for Russia’s increasing control of future shipping on the NSR involving its natural resources - to ‘give priority rights to users of domestic products’ according to the Russian Ministry of Industry and Trade.

Important political support came in December 2019 with the “Northern Sea Route Infrastructure Development Plan to 2035”.34 The first stage of the plan is to accelerate developments in the western part of the NSR between 2019–2024. The main goal here is to increase cargo throughput to 80 million tons in 2024 in line with the President Putin’s May decree of 2018. The second stage is the organization of year-round navigation during 2025–2030 through the eastern part of the NSR to the Russian Far East and NE Asia. The third and final stage of the plan is the organization of a competitive national and international transport corridor via the NSR during 2030–2035. A massive development of natural resources is needed for Russia to meet these ambitious targets.

Financial support by the state government for infrastructure development came in early 2020 in the form of large tax preferences or tax exemptions to act as a stimulus for new investments in resource extraction projects, infrastructure development and shipments on the NSR. The new legislation (Federal Law No. 193-F3 On State Support of Entrepreneurial Activity in the Arctic Zone of Russian Federation, July 2020) which applies until the end of 2035, provides a zero tax on production for the first 10 years for new energy and mineral extraction projects (12 years in the east Arctic). This also applies to infrastructure projects such as construction of seaports and industrial projects such as petrochemical plants. For offshore projects, a 5% production tax is required for the first 15 years of new projects. VAT tax on the export of commodities and for icebreaker services has also been eliminated for the first ten years. Direct governmental support is offered to companies generating the biggest economic impact in the area. Though the Russian government is encouraging foreign companies and banks to invest in Russian Arctic natural resource projects and transport infrastructure as minority stakeholders (commonly 10–20% for each foreign investor), the same does not apply to actual operations, which should only be in the hands of Russian companies, state-owned or independent. The Russian government has therefore a stronghold on future infrastructure and industrial development, including transportation through its regulatory framework and powerful state-owned companies.

To strengthen Russian control of shipping on the NSR, a new automated traffic and monitoring system (Unified Platform for Digital Services on the NSR) was installed at the headquarters of Atomflot in Murmansk during 2019–2020, with further developments in 2021–2022. The control center will use satellite monitoring systems to monitor the marine environment and shipping activities along the NSR. The center’s stated main task is to reenforce official navigational rules, provide up-to-date information on sea-ice conditions and local weather; determine vessels’ optimal routes; detect operational irregularities; and provide navigational warnings and emergency assistance. The control center plans to collect various ship operational data directly from the ships’ onboard information and sensor systems, including actual ice thickness and ice pressure measurements, and have excess to the ships’ onboard cameras. This last point could be a sensitive issue for non-Russian vessels. Also, an important prerequisite for the center’s future significance is improved communication and sea ice prediction systems (satellite networks) along the NSR.

5 Supply chain strategies on the NSR

To build up new maritime infrastructure along the NSR, Russian extractive companies have adopted common supply chain strategies to manage higher operational risks, and ensure more reliable supply chains for their production and the transport of commodities. Ten preventive and protective supply chain measures and maritime infrastructure initiatives used in the Russian Arctic are analyzed below, including their overall significance for future Arctic natural resource development.

5.1 Large supply and service hubs

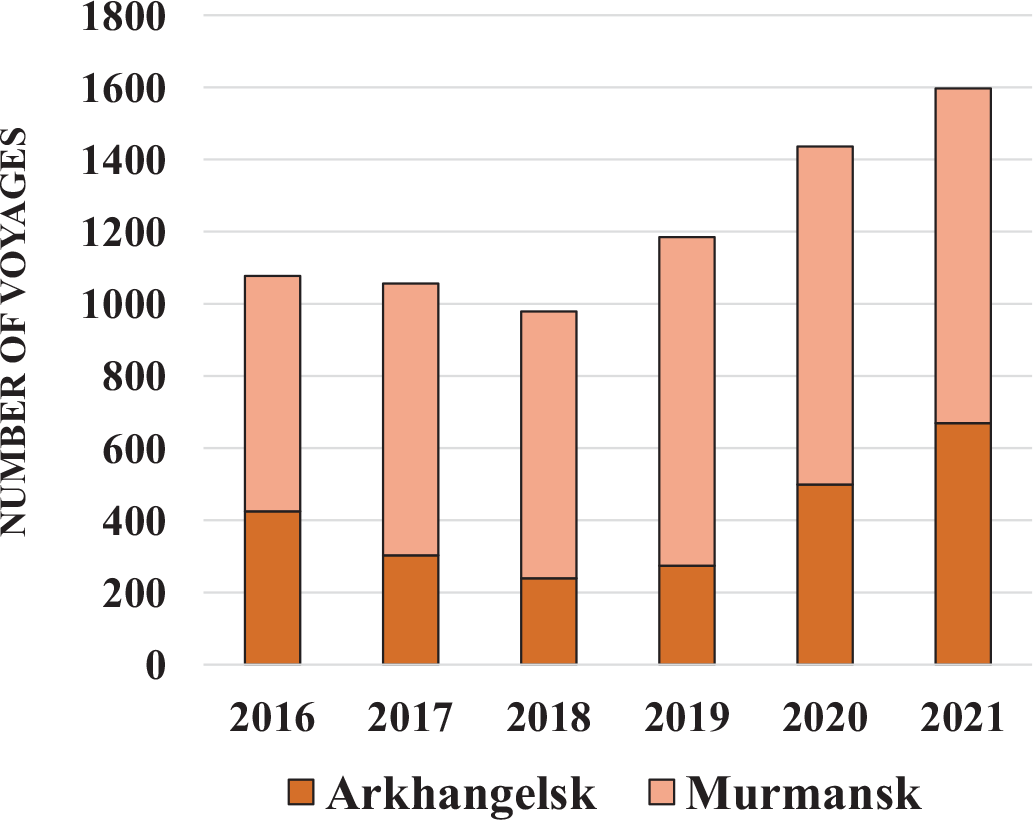

Dedicated supply and service hubs are essential for industrial and infrastructure development in the Arctic.35 Large resource extraction projects and terminal projects in the Arctic require large quantities of construction materials, machinery, equipment and supplies. All these elements need to be shipped to the Arctic from supply and service hubs. The hubs also provide critical facilities and services for Arctic operations, including: construction yards, dry-docks and repair facilities; storage facilities and warehouses; and a base for tugs, research vessels and icebreakers. To be most effective in providing services to Arctic projects, the hubs should also be situated in the high latitudes close to project sites, operate year-round, and provide deep-water access for larger ships, preferably in completely ice-free waters. Both Murmansk and Arkhangelsk serve as such hubs (Figure 6) for extractive projects in the Russian Arctic.36 Murmansk, however, is highly militarized area, which makes the port area sensitive to shipping by foreign vessels, and complicates foreign infrastructure investment. Arkhangelsk lacks a deep-water port, and the Northern Dvina River and the southern part of the White Sea freeze over during the winter-spring season, requiring icebreaker assistance.

Source: CHNL’s NSR Shipping Database.

5.2 Gravity-based structures and other large floatable concrete structures

Floatable structures such as ice-reinforced concrete gravity-based structures (GBS)37 and modular caissons38 are likely to become increasingly important for maritime and industrial development in the Arctic. GBS structures could provide the foundation for various resource extractive and industrial activities, including near-shore power generation, energy and ore processing plants, as well as various marine structures for harbor and terminal construction.39 Prefabricated LNG modules for LNG liquefaction units and other industrial units, can then be reassembled onto the floatable GBS foundations at large construction yards at some near-Arctic location (i.e., Murmansk), and then towed by several powerful tugboats to a desired location in the Arctic. This will avoid individual shipments and onsite module reassemblies in the Arctic. The use of such structures could reduce the capital cost and minimize the projects’ environmental footprint in the Arctic.40 This partly explains the projected $6 billion lower project cost for the much more compact Arctic LNG-2 plant, made-up of 42 modules to be constructed on three GBS foundations, compared to the Yamal LNG plant, which was constructed on land from 142 modules. Research has also shown that the construction and operational costs of floating ports is commonly less than land-based ports.41 The GBS with industrial units are secured to the seabed by their own weight and ballasting, after previous dredging and preparation of the seabed. First, detailed bathometric surveys and measurements of the geotechnical characteristics of the underlaying permafrost sediments are required, as the bearing strength of the underlying seabed can vary.

5.3 Large-scale dredging operations

Large-scale dredging is a precondition for resource development in most parts of the Russian Arctic. Arctic coastal shelves, river bays and estuaries generally have shallow waters, requiring extensive and continuous dredging of alluvial sediments to allow larger cargo vessels to navigate safely.42 The average water depth of the Ob Bay is 10–12 meters, and in some parts, it is only 2–3 meters. The sediments also become frozen (permafrost), and special vessels first have to cut the sediments into smaller pieces, whereupon a fleet of large dredgers remove the sediments, to be dumped back into the Bay at predetermined locations away from shipping lanes. This fleet of dredgers and support vessels has mainly been provided by companies from the Netherlands, Belgium and Luxembourg. Also, due to the transport of large amounts of alluvial sediments during the spring thaw within the watersheds of the Ob and Irtysh Rivers (as well as other Siberian rivers), dredging becomes a yearly challenge, and these costs have to be taken into account during the operational life of Arctic extractive projects. However, several resource extractive projects can benefit from the same dredging work since vessels from different projects use the main shipping channel in the Bay. It is also likely that future Arctic terminals will be located offshore at greater water depths to minimize the need for extensive and costly dredging of near coastal and river sediments.

5.4 Project-specific designs for Arctic export terminals

New export terminals are not currently under construction at any of the existing Arctic ports belonging to small coastal communities along the NSR. These community ports have not been maintained since the Soviet Era and all are in desperate need of upgrades and modernization.43 But the main reason that these ports remain in disuse is that the export terminals need to be as close as feasible to the extractive fields and be able to provide the necessary natural conditions and water depths for safe navigation and loading of large shuttle carriers. Subsequently, the structural design of new export terminals and their fleet of shuttle carriers is now taking place at the same time for each Arctic project. This has the potential to optimize safety and efficiency, and minimize the environmental impacts of cargo loading, based on the environmental and operational conditions of a particular extraction project. Export terminals also need to be designed to withstand high ice-loads from pressurized and drifting ice,44 and terminal foundations need to be strengthened and stabilized due to ongoing permafrost degradation.45

5.5 Shipments of commodities on project-specific high ice class shuttles

One of the key precautionary measures in the Russian Arctic is the use of powerful custom built, Arc7 double-acting (DAS) icebreaking cargo carriers with several Azipod units providing increased maneuverability in icy Arctic waters. Uncertainty of ice predictions46 and common interannual variability of sea ice coverage in the Arctic47 calls for high ice class vessels in year-round operations. High ice class cargo carriers can better accommodate frequent departure and arrival schedules at Arctic loading terminals. This is particularly important during the winter-spring season and to avoid vessels becoming stuck in ice.48 Consistency and reliability is essential when delivering large volumes of commodities with frequent and regular intervals. The carriers are designed to navigate through ice as thick as 2 meters without icebreaker assistance and operate at temperatures as low as -50°C. All are built according to the Polar Code requirements for operation under heavy ice conditions.49 This is done by designing and building the vessels based on the likely risks the vessels might encounter within a given Arctic area. These structural features make the vessels 2–3 times more expensive to build compared to conventional vessels of similar size and type, and fuel costs are up to 150% higher given the additional engine power and the increased weight of the ice-reinforced hull.50 Another important consideration in selecting the ice class of Arctic cargo carriers, which will be in service for at least 20 years, is that Russian resource companies plan to transport the majority of commodities from the Ob Bay and elsewhere along the NSR to the NE Asian market. Today most of the cargo is shipped westwards to the European market.51 Sailing eastwards from the Ob Bay along the whole length of the NSR in the winter-spring season will require high ice class vessels. Russia expects that the eastern route to NE Asia will be open for regular year-round traffic during the second half of this decade.52

5.6 Vessels assisted by powerful icebreakers

The impressive icebreaking capabilities of the Arc7 carriers in the Russian Arctic allows them to make most of their voyages during the 7-month long winter-spring season (December-June) without the assistance of nuclear icebreakers. Despite this fact, resource developers operating in the Russian Arctic have all made long-term contracts with the nuclear icebreaker operator Atomflot to assist the Arc7 cargo vessels.53 The Russian government drafted a legislative amendment to a previous bill in late 2020 requiring resource developers to make such long-term icebreaker agreements.54 This support from icebreakers is intended to guarantee uninterrupted operations during the winter-spring season in heavy ice conditions (e.g., in pressurized and hummocky ice). The powerful nuclear icebreakers have superior maneuverability compared to the larger and longer LNG carriers and oil tankers, and are better suited to break through thick ice ridges and find the best sailing tracks for the cargo carriers in heavy ice conditions. This is important within the Russian coastal seas and in the shallow waters of the Ob Bay and Yenisei River, where draught limitations are a major concern and deviating too much from recently charted navigational routes can be very dangerous. Escorting much larger LNG carriers is an important safety precaution. The icebreakers are also the most significant support unit for any vessel in distress and to provide emergency services and initial response to accidents or oil spills.55 With regular year-round shipments eastwards from the Ob Bay along the NSR to NE Asia, icebreaker support will be needed during the winter-spring season. Russia is also constructing a fleet of multi-purpose search & rescue (SAR) vessels to be placed in the ports and terminals along Russia’s Arctic coastline.56

5.7 Resource developers establishing own shipping companies

Russian resource developers are establishing their own shipping and logistics companies to operate their new fleet of vessels to transport commodities out of the remote Arctic.57 As mentioned before, this is in response to new regulations that only allow transport of hydrocarbons on the NSR on Russian owned and Russian built vessels. Nonetheless, resource developers state that establishing their own shipping companies provides added transport stability and promotes optimization of transport and logistics. Only Novatek’s Yamal LNG relies on transport by international shipping companies on the NSR (Dynagas, Teekay Shipping, and Mitsui O.S.K. Lines) on long-term charter contracts, together with one vessel owned and operated by the Russian Sovcomflot.58 Russian resource developers do not face any restrictions on partnerships with international shipping companies to transport commodities outside the borders of the NSR, or to transport commodities to final market locations. Novatek has already established a joint company with COSCO Shipping to transport commodities to the Asian market from a planned transshipment hub on Kamchatka.59

5.8 Vessels built by domestic shipyards

Russia has the stated goal to strengthen its domestic shipping and shipbuilding industry, which has been in a major slump since before of the fall of the Soviet Union.60 The new Zvezda Shipbuilding Complex near the city of Vladivostok in the Russian Far East has been designated as Russia’s main shipyard for future Arctic vessels. Zvezda is managed and largely funded by the Russian state-owned oil company Rosneft. All Russian high ice class cargo carriers for use on the NSR will be built at the Zvezda Shipyard. This is a purely political decision, which will without doubt lengthen the delivery time of critical Arctic shuttles and have, at least in the short-term, a negative impact on Russian Arctic resource development. But Russia is hoping that in the medium to long-term this will reactivate Russian domestic shipbuilding and boost Russian presence in its Arctic region. For Russia, high ice class LNG carriers with a membrane storage system, which is technically the most complicated aspect of shipbuilding, will in particular be troublesome. Zvezda obtained an international license in July 2020 and became the only Russian shipyard licensed to build such LNG carriers.61 To make this task easier or even possible, Zvezda made an agreement with South Korea’s Samsung Heavy Industries (SHI) to design and help in the construction of high ice class LNG carriers with membrane storage systems for the Arctic LNG-2 project in the Ob Bay.62

5.9 Transshipment terminals operated by resource developers

Resource developers (or their subsidiaries), manage their own transshipment terminals and the reloading to conventional vessels. The Russian oil and LNG companies opt for transshipment of their commodities to conventional vessels at ice-free locations outside the borders of the NSR, but within Russia (i.e., in the Kola Bay near Murmansk and on Kamchatka Peninsula). This is to avoid sailing high ice class vessels all the way to final market destinations. Shorter sailing distance optimizes the use of the Arc7 shuttles by increasing the yearly number of shipments from the Arctic and therefore reduces the number of expensive shuttles which are needed for each extraction project.63 This is relevant because the offloading and reloading of oil and LNG from a vessel normally only takes a day or two. So far, transshipment of crude oil and LNG has only been ship-to-ship, but more sophisticated floating reloading and storage platforms are being planned, in particular for LNG.64 Transshipment of other types of commodities from within the NSR, such as coal and iron ore from high ice-class to conventional dry bulk carriers, is a much more time-consuming operation and therefore impractical. Such vessels will need to sail from the Arctic all the way to faraway market locations. To reduce the cost of dry bulk vessels a lower ice-class has been suggested by some developers (e.g., Arc5) which would then require extensive and costly icebreaker support during the long winter-spring season.

5.10 Long-term delivery contracts for commodities

Russian Arctic resource developers are making long-term delivery contracts to customers for the majority of their output volumes. This allows the companies to better weather short-term drops in commodity prices and fluctuations on the freight market with pricing formulas aligned with international oil and gas benchmarks.65 Their long-term customers are mainly foreign investors who co-finance Russian resource extraction projects.

6 Intermodal sea-land transport connections in the Russian Arctic

Maritime transport of commodities from the Arctic is also dependent on other modes of transportation. The distance from extractive fields to export terminals can be from tens to even hundreds of kilometers. The raw material needs to be brought from the extractive fields to the export terminals for further processing (i.e. liquefaction of gas to LNG) and for export. For oil and gas this transport is by pipelines, but for coal and ores the transport needs to be by roads, railways, or inland waterways. Such other transport links are vital for maritime transport of Arctic resources. In general, the availability of different modes of transport optimizes the overall effectiveness of the whole transport system and its economic viability.66 Both east-west and north-south transport connections will make the NSR transport system more effective for the transport of commodities.67

There are rail and road connections between the larger cities in Northwest Russia, but this infrastructure does not currently exist in the Russian Arctic along the NSR. For a long time Russia has been planning to improve the railway system and connect the industrial complexes of the Urals and Western Siberian region with maritime transport on the NSR.68 So far, these plans have not materialized. However, there is one part of this overall system that is more likely to be developed, the Bovanenkovo-Sabetta Railway69 on the Yamal Peninsula, which will connect the port of Sabetta to the railway system further south and promote the transport of hydrocarbons and other types of cargo from different sources to the port.

The only existing large-scale ore mining operation in the Russian Arctic along the NSR is at Norilsk, with transport by railway to the export terminal at the port of Dudinka.70 The extraction of coal from the Syradasaysky field on the Taimyr Peninsula is planned with road transport to an export terminal (Severnaya Zvezda) on the northwest Taimyr coast.71

Due to the current lack of rail and road connections along the NSR, inland waterways provide the only transport connections to the hinterland. Several large Siberian rivers flow north into the Arctic Ocean and act as major transport connections from the interior of Siberia to the Arctic coast and to the NSR, potentially unlocking the large resource potential of Siberia. The Siberian rivers also offer possibilities for the transportation of project cargo and supplies from the NSR into Siberia.72 But the rivers are only ice-free for 3 to 4 months of the year (July-October), which limits their overall effectiveness as transport corridors. In the winter-spring, the rivers are used as ice-roads for transporting goods between river towns.73 Several upgrades of small Arctic airfields over the past few years have also strengthened logistics operations along the NSR.74 The largest such project is the international airport at Sabetta.

7 Impacts of recent Western sanctions on Russia’s Arctic projects

International sanctions on Russia following Russia’s invasion in Ukraine in February 2022 by the EU, United States, UK, Canada, Australia, Japan, South Korea and several other countries are likely to have negative impacts on Russia’s resource development in the Arctic. Sanctions on the export to Russia of targeted high-tech equipment and components, together with financial sanctions and an import embargo on Russian crude oil, oil products, and coal to Western countries, will both impact the Russian economy, and in particular be strongly felt by the LNG and offshore oil and gas sectors in the Arctic. These are the core activities of Russia’s future resource development in the Arctic, all relying heavily on Western know-how and technologies. Western companies have also been important investors in Russian LNG and crude oil projects as minority shareholders, and will now pull out of joint ventures or halt any further investments in Russia. Western sanctions on Russia following Russia’s annexation of Crimea in 2014 were nowhere near as severe as the current restrictions, only forbidding Western companies from providing goods, services and financing to certain Russian offshore and unconventional projects (e.g. shale gas). Now the new sanctions have essentially cut the entire Russian oil and gas sector off from Western support.

A major weakness for Russia’s resource development is its strong dependence on Western technologies, not easily replaced by Russia’s own high-tech industry or import substitution from other countries (e.g., China). Though Russia has been putting increased focus on its own industrial facilities and shipyards over the last few years, it is still highly dependent on Western technologies for its Arctic projects. Western companies have been hired to oversee engineering and the technical development of LNG plants in Russia, provide own patented liquefaction technologies used in the prefabrication of LNG modules and in the design of specialized Arc7 LNG carriers, as well as supply several key technical components for the shuttle carriers. According to Russia’s president in 2017, Russia will strive to become the world’s biggest LNG producer.75 However, the Yamal LNG plant is only Russia’s second LNG plant in operation, following the Sakhalin-2 LNG plant on Sakhalin Island in the Okhotsk Sea in the Russian Far East. To reach the president’s goal Russia needs to put much more emphasis on LNG technologies and engineering. It will likely take Russia several years to build up the same capabilities that Western contractors, suppliers and service firms have been providing in the Russian oil and gas sector.

Moreover, contracted shipping services by Western countries will now stop for future projects. Russia has relied on a fleet of Western heavy-lift carriers to transport large prefabricated LNG modules to the Russian Arctic from yards in East Asia. Western companies have also provided large-scale dredging services in the Ob Bay, and offshore supply vessels for drilling operations in the Kara Sea. Western shipping companies have also transported the majority of all the LNG produced at the Yamal LNG plant on their own vessels.

Russia is very dependent on the European market for its exports of oil and gas. The EU accounted for 61% of energy purchases from Russia during the first three months of 2022,76 and 71% of Russia’s gas exports in 2021 went to the EU,77 or 155 billion cubic meters (bcm). As a result of the invasion in Ukraine, Russia now needs to plan for a long-term reduction in the volume of oil and gas transported to the EU by both pipelines and by shipping from its Western Siberian fields and the Yamal-Nanets region. The EU plans to rapidly diversify its energy supplies and reduce its reliance of Russian oil and gas.78 In 2021 around 45% of the EU’s gas imports and 25% of crude oil imports came from Russia, based on data from Eurostat.

Russia could opt to redirect oil and gas pipelines that go to the EU today, to export terminals in the Gulf of Finland in the Baltic Sea (e.g., expand the port of Primorsk and Ust-Luga gas and oil product terminal). Another option might be to redirect pipelines to Russian territories in the Black Sea and ship the commodities from there (e.g. port of Novorossiysk). In both cases, the infrastructure needed to ship the commodities would include LNG liquefaction plants, oil refineries and petrochemical industries. There is currently insufficient tanker capacity for all of Russia’s exports to flow by sea, and seaborne traffic will be further constrained by EU-UK’s proposed ban on insuring Russian vessels, scheduled to come into effect by the end of 2022.

8 Importance of Arctic export terminals for Russia

Increased Russian focus on the Asian market became apparent after Russia was first sanctioned by the West after its annexation of Crimea in 2014. However, the necessary energy and transport infrastructure is not in place to reorient Russian pipeline exports from Europe to China. New pipeline infrastructure to China from fields in NW Russia would be very costly due to long distances and would take several years to complete. Since December 2019, Gazprom has operated the Power of Siberia gas pipeline from fields in Eastern Siberia to northeastern China with annual capacity gradually increasing to 38 bcm over several years, but the gas delivery in 2021 was only 10 bcm. This was the first gas pipeline connecting Russia to China. In the beginning of February 2022, before the war in Ukraine, Russia agreed to supply an additional 10 bcm of gas per year to China from fields in Russia’s Far East (Sakhalin).79 This comes in addition to Novatek’s shipments of LNG from the Ob Bay to China via the NSR since 2018. At the same time, Rosneft agreed to extend its 10 million tons/year oil agreement to western China via Kazakhstan. Russia has also been studying the possibility for a major new gas pipeline to China via Mongolia, the Power of Siberia 2, proposed to carry up to 50 bcm per year. This pipeline, if approved by both Russia and China, is designed to deliver gas from Western Siberian fields (Yamal) to the northern region of China, and subsequently divert pipeline gas from Europe to China.80 Project financing is still uncertain, though Chinese funding is most likely to be in the form of pre-payment for gas deliveries.

In light of the escalating geopolitical and military tensions between Russia and the NATO alliance following the war in Ukraine, both the Baltic Sea and the Black Sea locations are likely to have security limitations for Russia as export hubs. Instead, a more acceptable geopolitical solution for an increasingly isolated Russia would be to redirect pipelines north to the Russian Arctic and ship natural gas (as LNG) and crude oil directly from Arctic export terminals and along the NSR. There, in the Arctic Ocean and along its seasonal icy coastal seas, Russia is in full control of shipping over a vast territory, with future plans to build several export terminals (Figure 4). This is certainly not the case for Russia in the Baltic Sea or the Black Sea, both with geophysical and geopolitical limitations for Russia, and now according to Russia surrounded by “unfriendly countries”.

Directing oil pipelines north to the Arctic coast, instead of connecting to existing pipeline networks in the south, is also the plan for Rosneft’s new Vostok Oil megaproject. A network of pipelines will extend from several extractive fields in the Yamal-Nanets region (including Payakhskoe field) before being transported by a major pipeline to the Bay North (Buhta Sever) oil terminal (Figure 4). The oil terminal, scheduled to export up to 100 million tons of oil per year by 2030, is currently under construction about 30 km south of the town of Dikson on the remote northwest coast of the Taimyr Peninsula in the Kara Sea.81 The easiest and most cost-effective solution would have been to transport the oil by pipeline southward, and connect to already existing pipeline networks towards Europe. At present this is not a very attractive solution for Russia. Rosneft, with support from the Russian government, had already decided more than two years before the war in Ukraine, that the oil should be shipped on Russian tankers from the Arctic to global markets. Now the future of this estimated USD160 billion megaproject is in doubt or facing years of delays due to a lack of foreign investments, EU’s embargo on Russian oil, and lost access to Western equipment, services and technology.82 As mentioned before, Russia does not yet have a sufficient number of high ice-class oil tankers to transport the oil along the NSR to Asian markets during the winter and spring. However, Russia’s focus on the high Arctic does underline the increasing importance of Arctic export terminals for Russia’s future extractive industries and energy policy.

9 Conclusion

Russia is determined to utilize its vast Arctic resources and build-up large-scale industrial production within its Arctic zone. During the past several years Russia has clearly demonstrated that it is technically and financially feasible to extract natural resources throughout the year from remote parts of the Arctic, and ship large quantities of raw materials with regular intervals along its Arctic coast and to international markets. Russia has accomplished this despite environmental and climatic challenges and difficult operational conditions, including lack of any prior land-based or maritime infrastructure.

To compensate for the high operational risk, Russian extractive companies have adapted several precautionary and innovative logistics and supply chain solutions to reduce common Arctic risks. They have also taken control over their entire supply chains, from field exploration, basic infrastructure construction, production, to transport of commodities. This has promoted more effective coordination between various components of their supply chain, and allowed the companies to make year-round operations in the Arctic safer and more reliable. At the same time, the resource extractive industries in the Russian Arctic have become closely intertwined with Russian state development policies for the Arctic. The extraction projects are of great national interest to Russia and receive strong political and financial support from the Russian government. Preferred logistical solutions for all extraction projects developed into large package deals, where long-term production and transport arrangements for commodities, icebreaking services, and state support were all included.

Other Arctic States can learn from recent Russian experiences in the Arctic, and what is involved in sustaining year-round operations and regular transport of commodities to global markets. This applies to possible future resource development within the Canadian Arctic Archipelago, Alaska, and in Greenland. These regions face similar geographical restrictions and challenges as in the Russian Arctic. The same supply chain strategies and logistical solutions used in the Russian Arctic could apply there as well.

Construction and operational costs in the Arctic are much higher than for similar projects elsewhere, so only the most profitable extraction projects with large resource bases can afford these costly infrastructure solutions. In addition, demand for the commodities needs to be high, reflected in high commodity prices on global markets and favorable freight market conditions. To make each extraction project more profitable, maritime infrastructure and logistics solutions for similar projects in the same general area could be shared to reduce construction and operational costs for future projects. Based on the above discussion, these solutions could include: dredging of common sailing routes in the Ob Bay that benefit several extraction projects; using similar terminal design or sharing the use of the same (expanded) export terminal and transshipment terminal(s); building energy and mineral production plants on standardized GBS foundations instead of doing complicated module reassembly in the remote Arctic; build-up a common shipping fleet and optimizing the use of high ice-class shuttles; and coordinating and sharing icebreaker assistance within the same general area of operation.

Western sanctions on Russia, as a result of the war in Ukraine, will slow down the pace of future Russian projects in the Arctic, at least in the short to medium-term. However, the sanctions are likely to increase the future significance of export terminals on the NSR, as the preferred departure points for Russian Arctic commodities on their way to selective market destinations.

Acknowledgements

The financial support by the Norwegian Ministry of Foreign Affairs’ ARCTIC 2030 Project (NOR-15/0010) and the Collaborative and Knowledge-Building Projects to Meet Societal & Industry-Related Changes Program (BEAR Project 320266) is greatly appreciated (Björn Gunnarsson). Mr. Sergey Balmasov and his team at CHNL’s Information Office in Murmansk, Russia is thanked for the downloading of satellite AIS data from exactEarth and the management of CHNL’s Arctic Shipping Database used in this study. The authors thank the two anonymous reviewers for contributing to the improvement of the article.

NOTES

- 1. Björn Gunnarsson, “Recent ship traffic and developing shipping trends on the Northern Sea Route—Policy implications for future arctic shipping”, Marine Policy, 124 (2021): 104369; Frederic Lasserre, “Canadian Arctic Marine Transportation Issues, Opportunities and Challenges”, School of Public Policy Research Paper 15(6) (2022), http://dx.doi.org/10.11575/sppp.v15i1.72626.

- 2. Frederic Lasserre and Sébastien Pelletier, “Polar super seaways? Maritime transport in the Arctic: an analysis of shipowners’ intentions”, Journal of Transport Geography, 19(6) (2011): 1465–1473; Frederic Lasserre et al., “Polar Seaways? Maritime Transport in the Arctic: An Analysis of Shipowners’ Intentions II”, Journal of Transport Geography, 57 (2016): 105–114.

- 3. Philip Sauer and Stefan Seuring, “Sustainable supply chain management for minerals”, Journal of Cleaner Production, 151 (2017): 235–249.

- 4. Natalya Dolgova, “Oil and gas vertically integrated companies of Russia: logistics problems”, Metallurgical & Mining Industry, 8 (2017): 22–24; Elena Katysheva and Anna Tsvetkova, “The future of oil and gas fields development on the Arctic shelf of Russia”. 17th International Multidisciplinary Scientific GeoConference (SGEM 2017) Conference Proceedings, 17(53) (2017): 917–922, http://doi.org/10.5593/sgem2017/53/S21.114.

- 5. Taedong Lee and Hyun Jung Kim, “Barriers of voyaging on the Northern Sea Route: A perspective from shipping companies”, Marine Policy, 62 (2015): 264–270; Lasserre et al., “Polar Seaways?”, note 2; Marie-Andrée Giguère, Claude Comtois and Brian Slack, “Constraints on Canadian Arctic maritime connections”, Case studies on transport policy, 5(2) (2017): 355–366; Gunnarsson, “Recent ship traffic”, note 1; Björn Gunnarsson & Arild Moe, “Ten years of international shipping on the Northern Sea Route: trends and challenges”, Arctic Review on Law and Politics, 12 (2021): 4–30.

- 6. Tom Harwood, “Logistic problems in the Canadian Arctic”, Polar Record, 10(67) (1961): 365–371.

- 7. Björn Gunnarsson, “The future of Arctic marine operations and shipping logistics”, in The Arctic in World Affairs: A North Pacific Dialogue on the Future of the Arctic, eds. Oran Young, Jong Deong Kim and Yoon Hyong Kim (Seoul: Korea Maritime Institute and Hawaii: East-West Center, (2013): 37–61.

- 8. Antonina Tsvetkova, “The Idea of Transport Independence in the Russian Arctic: An Institutional Approach Towards Supply Chain Strategies”, Proceedings of the 28th Annual Nordic Logistics Research Network Conference, Nofoma 2016, Turku, (2016): 598–624.

- 9. Jürgen Weigell et al., “Sustainability in Arctic maritime supply chains”, in Data Science in Maritime and City Logistics: Data-driven Solutions for Logistics and Sustainability. Proceedings of the Hamburg International Conference of Logistics (HICL), vol. 30 (2020): 309–336.

- 10. Vitaly Sergeev, Igor Ilin and Alexey Fadeev, “Transport and Logistics Infrastructure of the Arctic Zone of Russia”, Transportation Research Procedia, 54(2021): 936–944.

- 11. Jacob Taarup-Esbensen and Ove Tobias Gudmestad, “Arctic supply chain reliability in Baffin Bay and Greenland”, Polar Geography, 45(2) (2022): 77–100.

- 12. Andy Tsay, Supply chain control with quantity flexibility (Doctoral dissertation, Stanford University, 1995).

- 13. Hoong Chuin Lau, Lucas Agussurja and Ramesh Thangarajoo, “Real-time supply chain control via multi-agent adjustable autonomy”, Computers & Operations Research, 35(11) (2008): 3452–3464.

- 14. Haralambos Sarimveis et al, “Dynamic modeling and control of supply chain systems: A review”, Computers & operations research, 35(11) (2008): 3530–3561.

- 15. S. Makris, P. Zoupas and G. Chryssolouris, “Supply chain control logic for enabling adaptability under uncertainty”, International Journal of Production Research, 49(1) (2011): 121–137.

- 16. Chuda Basnet and Stefan Seuring, “Demand-Oriented Supply Chain Strategies – A Review of the Literature”, SSRN (2014), http://dx.doi.org/10.2139/ssrn.2464375.

- 17. Mingyang Zhang et al., “Navigational risk factor analysis of Arctic shipping in ice-covered waters”, In Maritime Transport and Regional Sustainability, eds. Adolf Ng, Jason Monios and Changmin (London: Elsevier, 2019), 153–177; Emmaline Hill, Marc LaNore and Simon Véronneau, “Northern sea route: an overview of transportation risks, safety, and security”, Journal of Transportation Security, 8(3) (2015): 69–78; Charles Emmerson and Glada Lahn, “Arctic Opening: Opportunity and Risk in the High North”, Chatham House-Lloyd’s Risk Insight Report (2012), https://www.chathamhouse.org/2012/04/arctic-opening-opportunity-and-risk-high-north.

- 18. George Zsidisin and Michael Henke, “Revisiting supply chain risk”, in Revisiting supply chain risk, eds. George Zsidisin and Michael Henke (Los Angeles: Springer International Publishing, 2019), 1–14.

- 19. Paul Hopkin, Fundamentals of risk management (5th ed), (London: Kogan Page, 2018).

- 20. Erik Hollnagel, Robert Wears & Jeffrey Braithwaite, “From Safety-I to Safety-II: A White Paper”. National Health Service (NHS) (2015), https://www.england.nhs.uk/signuptosafety/wp-content/uploads/sites/16/2015/10/safety-1-safety-2-whte-papr.pdf, a. 30 Nov. 2022.

- 21. Jacon Taarup-Esbensen, “A resilience-based approach to risk assessments— Building resilient organizations under Arctic conditions”, Risk Analysis, 40(11) (2020): 2399–2412.

- 22. Gunnarsson and Moe, “Ten years of international shipping on the Northern Sea Route: trends and challenges”, note 5.

- 23. Hopkin, Fundamentals of risk management, note 19.

- 24. Frederic Lasserre and Pierre-Louis Têtu, “The geopolitics of transportation in the melting Arctic”, in A Research Agenda for Environmental Geopolitics, ed. Shannon O’Lear (Northampton (MA): Edward Elgar, 2020), 105–120.

- 25. Alexei Bambulyak, Björn Frantzen and Rune Rautio, “Oil transport from the Russian part of the Barents Region. 2015 Status report”, Akvaplan-niva and Norwegian Barents Secretariat, 2015, http://deb.akvaplan.com/downloads/Oil_Transport_2015_internet.pdf, a. 30 Nov. 2022.

- 26. Nivedita Kapoor, “Russia and the Future of the Arctic”, ORF Occasional Paper No. 336 (2021), https://www.orfonline.org/research/russia-and-the-future-of-the-arctic/, a. 30 Nov. 2022.

- 27. Wei Chai et al., “Statistics of thickness and strength of first-year ice along the Northern Sea Route”, J Mar Sci Technol. 26 (2021): 331–343; Arctic and Antarctic Research Institute (AARI), Operational Data 1997–2021: Arctic Ocean Ice Charts and Regional Ice Charts, 2021, http://www.aari.ru/main.php?lg=1&id=134, a. 30 Nov. 2022.

- 28. Pierre Thorez, “La Route maritime du Nord: Les promesses d’une seconde vie”, Le Courrier des Pays de l’Est, 1066 (2008): 48–59. https://doi.org/10.3917/cpe.066.0048.

- 29. Igor Frolov, “Development of the Russian Arctic Zone: challenges facing the renovation of transport and military infrastructure”, Stud. Russ. Econ. Dev. 26 (6) (2015): 561–566.

- 30. Chai et al., “Statistics of thickness and strength…”, note 27; AARI, Operational Data, note 27.

- 31. Gunnarsson and Moe, “Ten years of international shipping…”, note 22.

- 32. Arild Moe, “A new Russian policy for the Northern sea route? State interests, key stakeholders and economic opportunities in changing times”, The Polar Journal, 10(2) (2020): 209–227.

- 33. Ibid.

- 34. Government of the Russian Federation, План развития инфраструктуры Северного морского пути на период до 2035 года [Plan for the development of the Northern Sea Route infrastructure until 2035], n°3120, 21 Dec. 2019, http://static.government.ru/media/files/itR86nOgy9xFEvUVAgmZ3XoeruY8Bf9u.pdf, a. 30 Nov. 2022.

- 35. Pierre-Louis Têtu, Jean-François Pelletier and Frederic Lasserre, “The mining industry in Canada north of the 55th parallel: a maritime traffic generator?”, Polar Geography, 38(2) (2015): 107–122; Weigell et al., “Sustainability in Arctic maritime supply chains”, note 9; Gunnarsson, “Recent ship traffic and developing shipping trends…”, note ; Lasserre, “Canadian Arctic Marine Transportation Issues”, note 1.

- 36. Lasserre and Têtu, “The geopolitics of transportation in the melting Arctic”, note 24; Gunnarsson, “Recent ship traffic and developing shipping trends…”, note 1.

- 37. Joar Tistel et al., “Gravity-Based Structure Foundation Design and Optimization Opportunities”. Proceedings of the 25th International Ocean and Polar Engineering Conference, Kona, Hawaii, June 21–26, 2015, International Society of Offshore and Polar Engineers (ISOPE) (2015): 315–352.

- 38. Nigel Chattey, “Modular caissons for use in constructing, expanding and modernizing ports and harbours”, US Patent No. 5,803,659, 1995, https://patents.justia.com/patent/5803659.

- 39. Ibid.; Ingo Drummen and Gerrit Olbert, “Conceptual Design of a Modular Floating Multi-Purpose Island”, Frontiers in Marine Science, 8 (2021): 615222, https://doi.org/10.3389/fmars.2021.615222.

- 40. Sea News, “Arctic LNG-2 Participants Conclude 20-year Offtake Agreements, Sea News”, 29 April 2021, https://seanews.ru/en/2021/04/29/en-arctic-lng-2-participants-conclude-20-year-offtake-agreements/, a. 30 Nov. 2022.

- 41. Alfred Baird and Dirk Rother, “Technical and economic evaluation of the floating container storage and transhipment terminal (FCSTT)”, Transportation Research Part C: Emerging Technologies 30 (2013): 178–192.

- 42. Heiner Kubny, “Problematic changes in the Gulf of Ob?” Polar Journal, 9 Sept. 2020, https://polarjournal.ch/en/2020/09/09/problematic-changes-in-the-gulf-of-ob/.

- 43. Dmitry Kuzmin, Andrei Baginov and Sergey Levin, “The Northern Sea Route in the conditions of the global economic environment of the transport market”, E3S Web of Conferences, EDP Sciences, vol. 91 (2019): 8057; Julie Babin, Frederic Lasserre and Pauline Pic, “Arctic Shipping and Polar Seaways”, in Encyclopedia of Water: Science, Technology, and Society, ed. P. Maurice (Hoboken (NJ): Wiley, 2019), Section 140, 1539–1550.

- 44. Flemming Christensen, “Ice ride-up and pile-up on shores and coastal structures”, Journal of Coastal Research, 10(3) (1994): 681–701; Hans Agerschou et al., Planning and design of ports and marine terminals, 2nd (London: Telford, 2004); A. Jensen et al., “Challenges related to offshore oil loading and transportation in the Arctic”, INTSOK Conference, 15–18 March 2005, Houston, Oil and Gas Developments in Arctic and Cold Regions.

- 45. Jaroslav Obu et al., “Northern Hemisphere permafrost map based on TTOP modelling for 2000–2016 at 1 km2 scale”, Earth-Science Reviews 193 (2019): 299–316.

- 46. Lasserre, “Canadian Arctic Marine Transportation Issues”, note 1.

- 47. John Mioduszewski et al., “Past and future interannual variability in Arctic sea ice in coupled climate models”, The Cryosphere, 13(1) (2019): 113–124.

- 48. Pascale Bourbonnais and Frederic Lasserre, “Winter shipping in the Canadian Arctic: toward year-round traffic?” Polar Geography, 38(1) (2015): 70–88; Sriram Rajagopal and Pengfei Zhang, “How widespread is the usage of the Northern Sea Route as a commercially viable shipping route? A statistical analysis of ship transits from 2011 to 2018 based on empirical data”, Marine Policy, 125 (2021): 104300.

- 49. IMO Polar Code, 2017, https://www.imo.org/en/OurWork/Safety/Pages/polar-code.aspx and https://www.icetra.is/media/english/POLAR-CODE-TEXT-AS-ADOPTED.pdf, a. 30 Nov. 2022.

- 50. Tomi Solakivi, Tuomas Kiiski and Lauri Ojala, “The impact of ice class on the economics of wet and dry bulk shipping in the Arctic waters”, Marine Policy & Management, 45(4) (2018): 530–542.

- 51. Gunnarsson, “Recent ship traffic”, note 1.

- 52. Mikhail Belkin, “Improvement of the icebreaking capacity to guarantee year-round navigation via the Northern Sea Route”, Presentation at the International Arctic Shipping Seminar, 12 December 2019, Busan, South Korea. Organized by Youngsan University and hosted by the Korean Ministry of Oceans and Fisheries.

- 53. Arild Moe, “A new Russian policy for the Northern sea route?”, note 32.

- 54. Rosatom, “New legislation amendments make it possible to conclude long-term agreements for the provision of icebreaker assistance services for a ship along the Northern Sea Route”, Legislative amendments, 18 October 2020, http://arcticway.info/en/new-legislation-amendments-make-it-possible-conclude-long-term-agreements-provision-icebreaker, a. 30 Nov. 2022.

- 55. Dimitrios Dalaklis, Megan Drewniak & Jens-Uwe Schröder-Hinrichs, “Shipping operations support in the “high north”: examining availability of icebreakers along the Northern Sea route”, WMU Journal of Maritime Affairs, 17(2) (2018): 129–147.

- 56. Mikhail Belkin, “Northern Sea Route Infrastructure Development Policy”, Presentation at the International Arctic Shipping Seminar, 9 December 2021, Busan, South Korea. Organized by Youngsan University and hosted by the Korean Ministry of Oceans and Fisheries.

- 57. Gunnarsson and Moe, “Ten years of international shipping…”, note 22.

- 58. Ibid.

- 59. Marcus Hand, “Cosco Shipping, Sovcomflot, Novatek and Silk Road Fund in Arctic LNG shipping venture”, Seatrade Maritime News, 7 June 2019, https://www.seatrade-maritime.com/asia/cosco-shipping-sovcomflot-novatek-and-silk-road-fund-arctic-lng-shipping-venture, a. 30 Nov. 2022.

- 60. Elena Efimova and Sergei Sutyrin, “Government support for the Russian shipbuilding industry: Policy priorities and budgetary allocations”. BSR Policy Briefing Series, Centrum Balticum, May 2019, https://www.centrumbalticum.org/files/4341/BSR_Policy_Briefing_5_2019.pdf.

- 61. Zvezda, “Zvezda worldwide license for LNG carriers”, undated (probably 2020), https://www.sskzvezda.ru/index.php/en/9-news-en/402-zvezda-shipyard-got-a-worldwide-license-for-construction-of-lng-carriers.

- 62. Yonhap News Agency, “Samsung Heavy to design icebreaking LNG carriers for Russian shipyard”, 4 Sept. 2019, https://en.yna.co.kr/view/AEN20190904008700320, a. 30 Nov. 2022.

- 63. Gunnarsson, “Recent ship traffic”, note 1.

- 64. MOL Mitsui O.S.K. Lines, “MOL Signs a Letter of Intent with Russian State-owned Leasing Company GTLK for the World Largest FSU Projects in Kamchatka and Murmansk”, Press Release, 2 September 2021, https://www.mol.co.jp/en/pr/2021/21076.html, a. 30 Nov. 2022.

- 65. Sea News, “Arctic LNG-2 Participants Conclude 20-year Offtake Agreements”, note 40.

- 66. Jean-Paul Rodrigue, The geography of transport systems (New York: Routledge, 2020).

- 67. Malte Humpert, “The Future of the Northern Sea Route – A “Golden Waterway” or a Niche Trade Route”, The Arctic Institute, 15 Sept. 2011, https://www.thearcticinstitute.org/future-northern-sea-route-golden-waterway-niche/, a. 30 Nov. 2022; Lasserre and Têtu, “The geopolitics of transportation in the melting Arctic”, note 24; Tristan Kerderdine, “Northern Corridor for Central Asia-Arctic Ocean Transport Access”, The Arctic Institute, 9 Nov. 2021, https://www.thearcticinstitute.org/northern-corridor-central-asia-arctic-ocean-transport-access/; Tristan Kenderdine, Albina Muratbekova and Niva Yau, Northern Corridor— Arctic Maritime Transport Integration in Central Asia. Policy Paper prepared for Central Asia Regional Economic Cooperation Program Institute, Asian Development Bank, 2021.

- 68. H. Smolka, “The economic development of the Soviet Arctic”, Geographical Journal, 89(4) (1937): 327–338; Tadeusz Pastusiak, The Northern Sea Route As a Shipping Lane (Basel: Springer, 2016); Paul Goble, “Stalin did not succeed in building Northern Railway and neither will Putin”, Eurasia Daily Monitor 15(22) (2018), https://jamestown.org/program/stalin-not-succeed-building-northern-railway-neither-will-putin/, a. 30 Nov. 2022.

- 69. Lasserre and Têtu, “The geopolitics of transportation in the melting Arctic”, note 24; The Arctic.ru, “Putin calls for launching construction of Yamal railway”, The Arctic.ru, 21 April 2021, https://arctic.ru/infrastructure/20210421/992950.html, a. 30 Nov. 2022.

- 70. Marlène Laruelle and Sophie Hohmann, “Biography of a polar city: Population flows and urban identity in Norilsk”, Polar Geography, 40(4) (2017): 306–323.

- 71. Arctic Russia, “Development of the Syradasayskoye coal deposit in Taimyr is on schedule”, 1 April 2022, https://arctic-russia.ru/en/news/development-of-the-syradasayskoye-coal-deposit-in-taimyr-is-on-schedule/; Arctic Russia, a. 30 Nov. 2022.

- 72. Gunnarsson, “Recent ship traffic”, note 1; Lasserre and Têtu, “The geopolitics of transportation in the melting Arctic”, note 24; Kenderdine et al., Northern Corridor— Arctic Maritime Transport Integration in Central Asia, note 67.

- 73. Siberian Times, “The world’s most amazing highways, along frozen Siberian rivers”, 25 Dec. 2017, https://siberiantimes.com/other/others/features/merry-christmas-from-the-six-santas-of-siberia/the-worlds-most-amazing-highways-along-frozen-siberian-rivers/.

- 74. Alexandr Ter-Akopov and Vadim Bezverbny, “Development of transport systems in Siberia and the Far East of Russia: socio-economic and natural-climatic factors”, Journal of Environmental Management & Tourism, 10(5 (37)) (2019): 1074–1083.

- 75. Offshore Energy, “Putin says Russia will become world’s top LNG producer”, 30 March 2017, https://www.offshore-energy.biz/putin-says-russia-will-become-worlds-top-lng-producer/.

- 76. CREA, “Financing Putin’s war: Fossil fuel imports from Russia in the first 100 days of the invasion”, Centre for Research on Energy and Clean Air, 13 June 2022, https://energyandcleanair.org/wp/wp-content/uploads/2022/06/Financing-Putins-war-100-days_20220613.pdf, a. 30 Nov. 2022.

- 77. Maxim Timchenko, “Europe can replace its lost Russian energy supply with this surprising partner”, World Economic Forum Annual Meeting, Davos, 24 May 2022, https://www.weforum.org/agenda/2022/05/europe-can-replace-its-lost-russian-energy-supply-with-this-surprising-partner/, a. 30 Nov. 2022.

- 78. Zia Weise and Zosia Wanat, “Commission plans to get EU off Russian gas before 2030”, Politico, 8 March 2022, https://www.politico.eu/article/commission-plan-eu-russia-gas-2030/, a. 30 Nov. 2022; Bill Chappell, “The EU just proposed a ban on oil from Russia, its main energy supplier”, NPR, 4 May 2022, https://www.npr.org/2022/05/04/1096596286/eu-europea-russia-oil-ban, a. 30 Nov. 2022.

- 79. Vitaly Yermakov and Michal Meidan, “Russia and China Expand Their Gas Deal: Key Implications”, The Oxford Institute for Energy Studies, March 2022 https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/03/Russia-and-China-Expand-Their-Gas-Deal-Key-Implications.pdf, a. 30 Nov. 2022.

- 80. Jeff Pao, “Power of Siberia 2 to divert Europe-bound gas to China”, Asia Times, 20 July 2022, https://asiatimes.com/2022/07/power-of-siberia-2-to-divert-europe-bound-gas-to-china/, a. 30 Nov. 2022.

- 81. Atle Staalesen, “Russia’s biggest oil project rises on coast of Yenisey Bay”, The Barents Observer, 19 November 2021, https://thebarentsobserver.com/en/industry-and-energy/2021/11/russias-biggest-oil-project-rises-coast-yenisey-bay, a. 30 Nov. 2022.

- 82. Bne IntelliNews, “Fade of Russian Arctic megaproject Vostok Oil up in air amid sanctions, EU embargo”, 13 June 2022, https://www.intellinews.com/fate-of-russian-arctic-megaproject-vostok-oil-up-in-air-amid-sanctions-eu-embargo-247316/?source=russia, a. 30 Nov. 2022.